How Lendingkart Improved Customer Trust and Compliance Across Thousands of Conversations

Lendingkart is a leading MSME lending platform in India, connecting small businesses in need of working capital with a network of co-lenders. With operations spanning across the country, their customer engagement spans multiple languages, channels, and long loan life cycles — from lead acquisition to repayment.

The Challenge

Lendingkart’s customer engagement journey is complex and compliance-heavy, with hundreds of critical “moments” across sales, credit underwriting, loan disbursal, servicing, and collections.

Key challenges included:

- Manual Quality Checks – Less than 10% of calls were audited, leaving gaps in compliance tracking and agent performance measurement.

- Language Limitations – Existing tools worked only for English (and with limited accent coverage), ignoring the rich multilingual landscape of Lendingkart’s customer base.

- Data Loss from Untracked Commitments – Agent follow-ups like “Call me tomorrow at 5:30” were often missed, leading to lost opportunities and reduced customer satisfaction.

- Inconsistent Process Adherence – Ensuring agents followed all 100+ compliance and customer-handling steps was resource-intensive and error-prone.

- Missed Intelligence – Customer intent, propensity to convert, and early risk flags were difficult to detect in real-time.

Mapping the Solution to the Pain Point: The ConvoZen.AI Value Matrix

Lendingkart deployed ConvoZen AI, a conversation intelligence platform built for the Indian market, integrating seamlessly across calls, chats, emails, and social media.

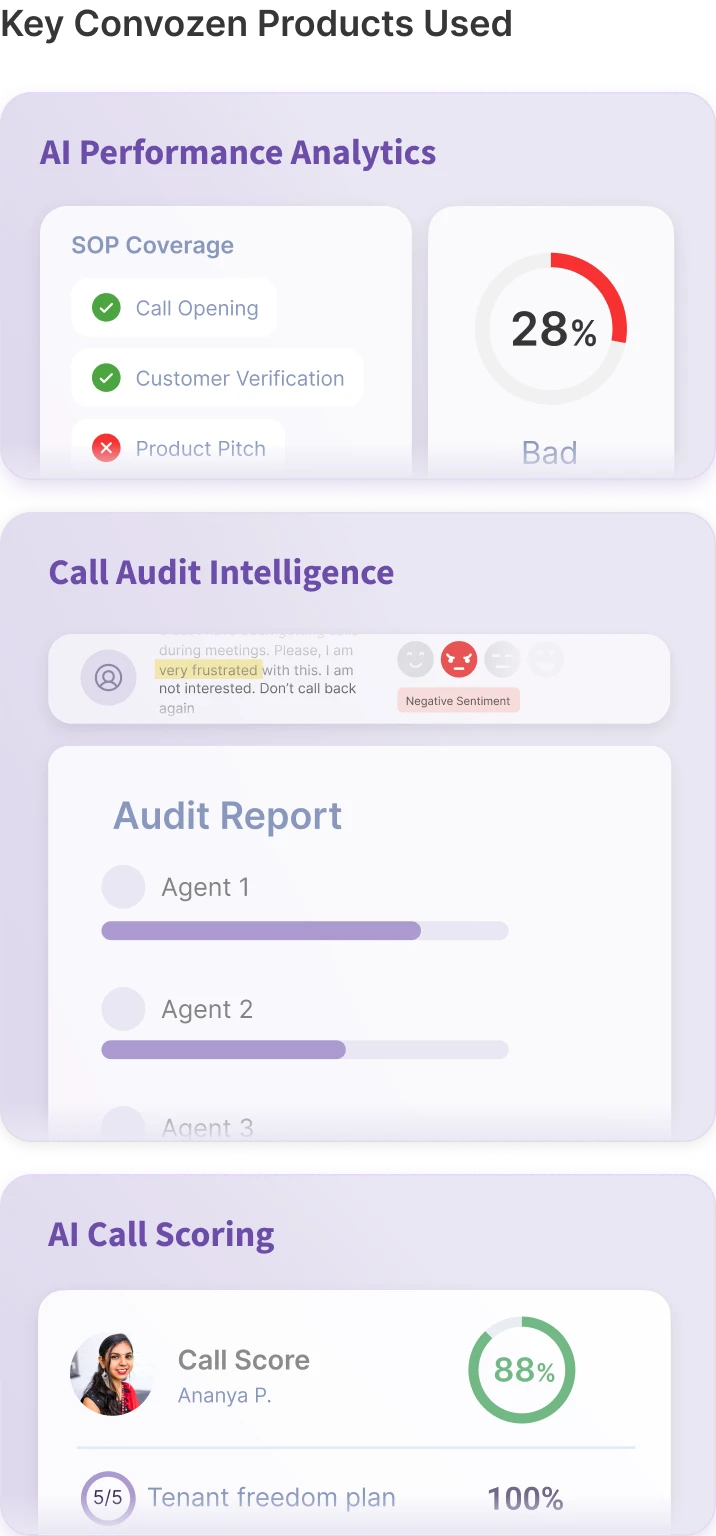

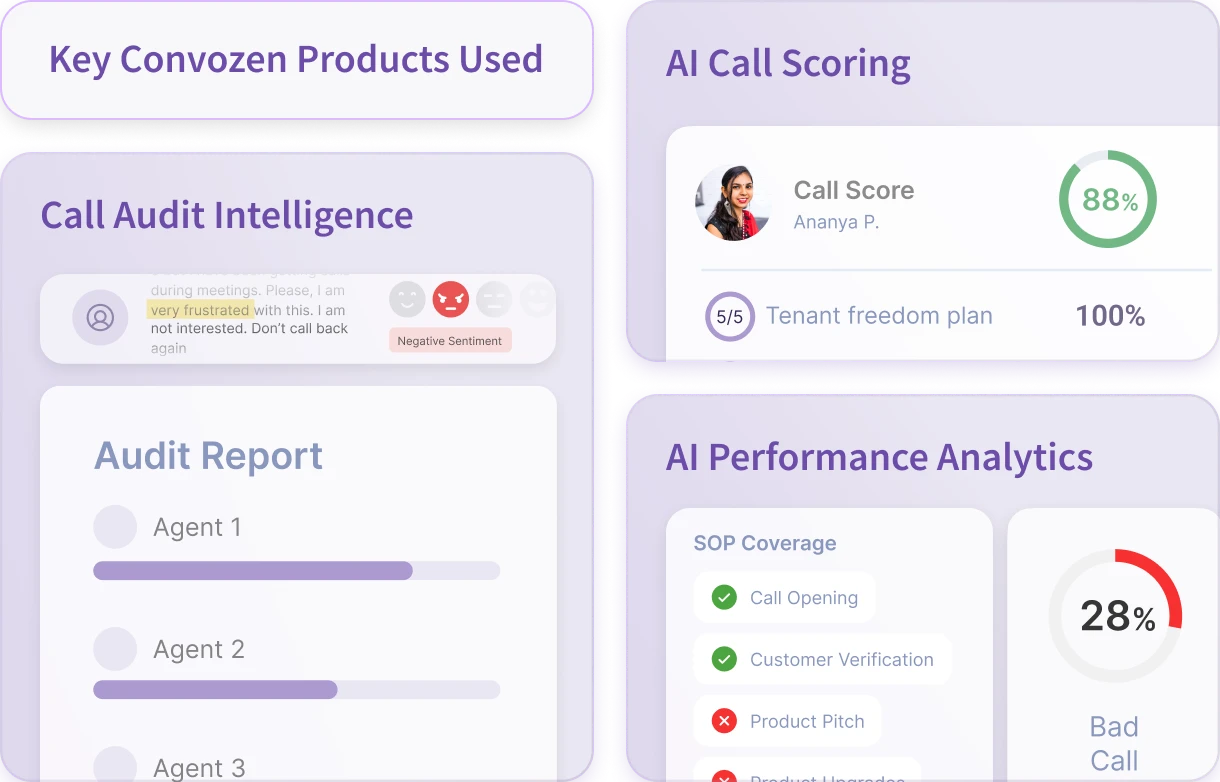

Key capabilities leveraged:

- 100% Automated Quality MonitoringAI-based monitoring of all conversations across multiple languages, with instant flagging of compliance or process deviations.

- Multilingual Speech-to-Text & InsightsAccurate transcription and moment detection across Indian languages and dialects, enabling intelligence extraction from previously untapped customer segments.

- Propensity & Risk ScoringAI models detecting buying intent, likelihood to convert, and red flags requiring stricter credit checks — across single or multiple conversations.

- Real-Time CRM Event IntegrationAutomatic creation of follow-up tasks when customers request callbacks, ensuring zero lead loss at critical stages like KYC or disbursal.

- Product Feedback LoopMining unstructured conversation data for product and process improvement, enabling self-serve feature enhancements in Lendingkart’s app and website.

Impact at a Glance

- Quality Coverage: Jumped from <10% to ~100% of conversations monitored automatically.

- Conversions: Achieved a double-digit percentage lift in customer conversion rates.

- Compliance: Automated 100+ process checkpoints, slashing manual QC time.

- Follow-Ups: Near-zero missed callbacks through real-time CRM task creation.

- Product Speed: Faster self-serve feature rollouts driven by live customer insights.

Overall Business Impact:

ConvoZen gave Lendingkart a 360° customer view, ensured pan-India compliance in multiple languages, boosted sales velocity, and freed teams from low-value manual work — enabling sharper focus on strategic, high-impact engagement.

“We’ve gone from auditing a single-digit percentage of calls to monitoring virtually every interaction in real-time. The insights we now get from multiple languages and channels are unmatched, and ConvoZen has directly helped us improve conversions, compliance, and customer experience.” — Giridhar Yasa, CTO at LendingKart